In August 2022, the Inflation Reduction Act (IRA) came into effect to alleviate inflation, cut energy costs for Americans, and reduce global warming. But what does this mean for you as a homeowner?

Well, the good news is that the Act includes two provisions that offer tax credits or rebate savings for those who make the switch to greener heating and cooling heat pump systems.

The Energy Efficient Home Improvement Credit and the High Efficiency-Electric Home Rebate Program can help you save money while reducing your carbon footprint. If you’re considering upgrading your heating system, now is the perfect time to take advantage of these savings– you may even be eligible for the full $8,000 rebate!

By switching to a greener heating and cooling system, you’ll make significant savings while also doing your part in reducing climate change. So, here’s everything you need to know about heat pumps and tax credit or rebate savings programs.

The Inflation Reduction Act

What do you need to know about the Inflation Reduction Act to qualify? Reading through the entire Act could take some time. So here’s a brief overview of what we think you need to know.

The Background

Brought into law in August 2022, the IRA has pledged more money towards climate change than any US bill in the past. It’s serious about lowering carbon emissions (aiming to reduce emissions by 40% by 2030) and offering cash incentives to homeowners to help them achieve this goal.

The Act also plans to reduce healthcare costs by lowering prescription costs and prevent giant corporations from avoiding tax. It’s taken the Democrats over a year to push this bill through, but as a result, you should benefit from lower energy costs.

What the Act Means for You

Let’s dive into the details even more. As a homeowner, if you’re eager to switch to more eco-friendly energy options such as electric vehicles and heat pumps, you can use new IRA Energy Efficient Tax Credits to help with the cost.

In addition, if you’re from a lower-income household, you may be eligible for the IRA’s heat pump rebate, which covers anywhere from 50% to the entire installation cost.

The good news about this Act is that everyone can benefit from switching to sustainable energy sources regardless of income. And by installing a Federal Energy Efficient heat pump, you’ll continue to save well into the future with lower energy bills.

What is a Heat Pump?

Wouldn’t using natural energy sources rather than burning fuel to heat and cool our homes be great? That’s what a heat pump does. It uses a small amount of electrical energy to transfer heat around your home.

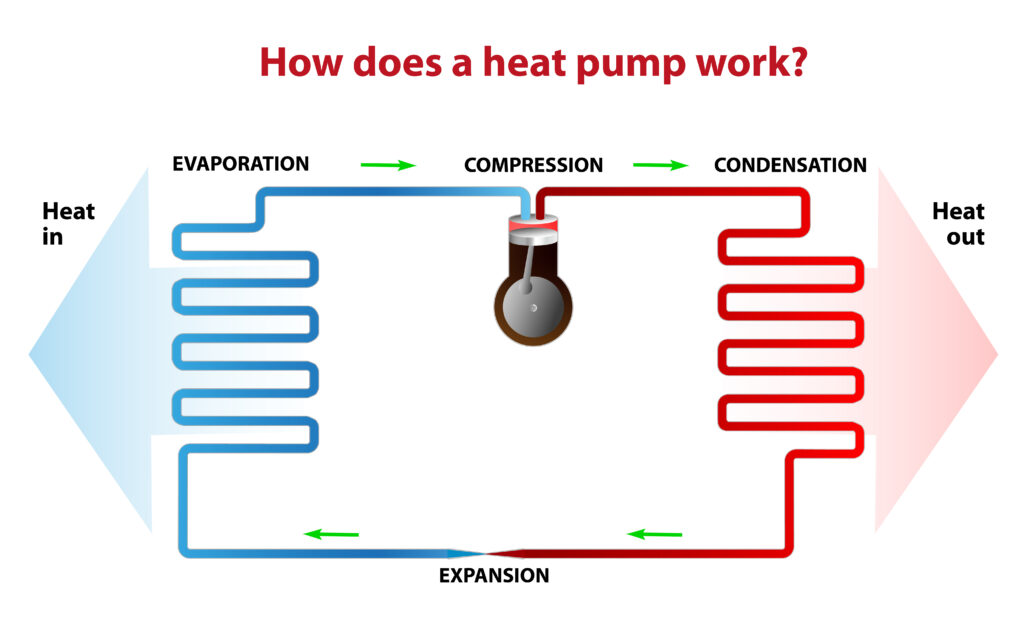

In simple terms, a heat pump uses a cold refrigerant to transfer heat. The refrigerant starts in the outer coil, which picks up heat from the outside air (or ground), leading to evaporation. Next, the gas is pumped through a compressor which increases the heat.

Eventually, the gas flows through a coil in the system placed inside your home. The cooler air causes the gas to condense, releasing its heat while turning it back into a liquid. Then, the fluid is pumped back through to the outer coil, and the process begins again.

There are different types of heat pumps. Some use the warmth from the ground, whereas some use the warmth from the air. Whichever option you choose, you’re guaranteed lower energy bills. To learn more about which system suits your home, speak to your local HVAC professionals.

Benefits of an Energy-Efficient Heat Pump

There are several benefits to having a heat pump installed, including:

Lower Utility Bills

Heat pumps use less energy than other heating systems, so you can save money on your energy bills each month. Combined with the available rebates and tax credits, this is a great way to save money now and in the future.

State Requirements

Some states are requiring greener forms of energy as part of a zero-carbon emissions policy. If your state doesn’t have current requirements, it’s possible they will adopt some in the near future.

Eco-Friendly

Heat pumps burn less fuel and natural resources, making them a more eco-friendly options to heat your home. You’ll not only be doing your part for the environment, but you will save some money in the process.

Which Systems Qualify?

Not every system qualifies for a tax credit or rebate savings. There are specific standards and regulations to meet. So, bear the following in mind when purchasing a heat pump system for your home.

Energy Star Systems

It’s essential to check if a heat pump has an Energy Star Certification to ensure you get the most energy-efficient option. This certification proves that the product has undergone rigorous testing and met the standards set by the EPA, with over 500 approved labs supervising the process.

Different Systems Covered

If you’re unsure whether a heat pump is right for you, consider replacing your HVAC, furnace, or boiler instead. However, remember that these replacement systems must also meet energy-efficiency standards to qualify for savings.

CEE Tier 1 & 2 Requirements

To qualify for rebates on heat pump purchases, you must select a heat pump that meets the criteria for Tier 1 or 2 of the Consortium of Energy Efficiency (CEE). This means that split-system ducted heat pumps must be within Tier 1, and non-ducted heat pumps fall into Tier 2.

What Federal Tax Credits Are Available?

Tax 25C

This tax credit is a nonbusiness property energy credit. It allows you to claim up to 30% capped tax credit for installing energy-efficient products like heat pumps, water heaters, and electric panels or for carrying out energy audits.

The excellent news about this credit is that it’s not a lifetime credit. It renews yearly. Anyone with adequate tax liability to offset can qualify for Tax 25C.

Tax Credit Amounts

There are various amounts allocated to different products and appliances. However, the principal amounts are as follows:

- Heat Pumps – up to $2,000

- Air Conditioners – up to $600

- Furnaces – up to $600

HEEHRA Act Energy Efficiency Rebates

If you don’t think you can afford a new heat pump, some good news is coming. If your household income is 80% less than the average income in your area, you can gain a rebate for the full cost of a new heat pump, up to the value of $8,000.

And households with an income of 80%-150% of the median average income qualify for a rebate of up to 50%.

Beyond that, you can also get rebates for other energy-saving products:

- Electric stove/cooker top, up to $640

- Electric wiring, up to $2,500

- Weatherization, up to $1,600

- Heat Pump Water Heater, up to $1,700

So whatever your income, you can move towards more sustainable energy sources.

Save More with Local Energy Rebates

It isn’t only Federal rebates and tax credits that you can claim. Many States have their own set of financial incentives for switching to greener energy. It’s worth checking out your local energy office to see what you’re eligible for.

Also, check out the Energy Star Rebate Finder to see if you qualify for extra rebates on Energy Star Certified products.

Combining State and Federal Rebates

Before you do a happy dance over getting both State and Federal rebates, we need to point out that combining both is still a little unclear. At present, as long as the State rebate isn’t funded with Federal money, it’ll be upheld.

These rules and regulations are down to the individual State and could be subject to change as the rebate system is established.

How to Apply for Tax Credits and Rebates

Knowing the difference between tax credits and rebates savings will help you determine the right time to purchase a heat pump.

If you want money off the purchase price at the time of buying, you need a rebate. However, rebates are only available for low to moderate income families. You find a contractor, they sort out the paperwork and give you a discount at the time of purchase.

For those not eligible for a rebate, you can get up to 30% off by applying for a tax credit. These credits offset your tax bill or provide a greater tax refund. However, you must be able to pay the total purchase costs without a discount.

If you’re unsure how to complete your tax form to apply for the tax credit, our advice is to consult your tax advisor. The experts know how to complete the form to ensure you get the full tax credit that you’re entitled to claim.

Want to find out more about Federal Energy Efficient heat pumps? Contact the HVAC experts at ASI for professional advice and guidance.